Get the free form 8453 llc

Show details

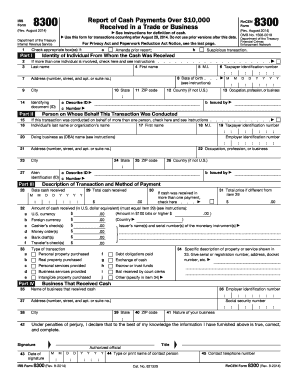

DO NOT MAIL THIS FORM TO FT Date Accepted TAXABLE YEAR 2010 1 2 3 4 5 Limited liability company name California e-file Return Authorization for Limited Liability Companies FORM 8453-LLC Identifying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8453 llc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8453 llc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8453 llc online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 8453 llc form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out form 8453 llc

How to fill out form 8453 LLC:

01

Obtain the form: Form 8453 LLC can be downloaded from the official website of the Internal Revenue Service (IRS) or obtained from a tax professional.

02

Provide entity information: Enter the name, address, and Employer Identification Number (EIN) of the LLC for which the form is being filled out.

03

Attach supporting documents: If there are any attachments required, such as schedules or statements, make sure to include them with the form. Additionally, ensure that these documents are properly labeled and organized.

04

Complete the declaration: Read the declaration statement carefully and sign and date the form to indicate that the information provided is true, accurate, and complete to the best of your knowledge.

05

Submit the form: Once the form is filled out and signed, send it to the appropriate IRS address provided in the instructions.

Who needs form 8453 LLC:

01

Limited Liability Companies (LLCs) filing their tax returns electronically: LLCs who choose to file their tax returns electronically, instead of on paper, are required to file Form 8453 LLC.

02

LLCs with attached schedules or statements: If an LLC has certain schedules or statements that cannot be filed electronically, they must complete and attach Form 8453 LLC to their tax return.

03

LLCs using a tax preparer: Tax professionals, who file tax returns electronically on behalf of an LLC, may ask the LLC to complete Form 8453 LLC to enable e-signature authorization for e-filing.

Note: It is always recommended to consult a tax professional or refer to the IRS guidelines for specific instructions and requirements regarding Form 8453 LLC.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8453 llc?

Form 8453 LLC is a document used by Limited Liability Companies (LLCs) in the United States to authorize an electronic submission of their tax returns to the Internal Revenue Service (IRS). This form is typically used when an LLC wants to file their tax return electronically but cannot sign it with a physical signature. Form 8453 LLC serves as a declaration that the LLC's income tax return is true, correct, and complete. It authorizes the tax preparer or a designated third-party to electronically sign and file the tax return on behalf of the LLC.

Who is required to file form 8453 llc?

A limited liability company (LLC) is required to file Form 8453 if they meet certain criteria. Here are the instances when an LLC may need to file Form 8453:

1. If the LLC is filing their tax return electronically and has attachments that cannot be e-filed, they must file Form 8453 to submit those attachments manually.

2. If the LLC is electing to use a paper return instead of electronically filing, they may need to file Form 8453 to submit certain attachments along with their paper return.

3. If the LLC is required to file certain information returns, such as Form 1099, they may need to file Form 8453 to submit those information returns manually.

In general, Form 8453 is used to submit attachments or supporting documents manually when e-filing is not possible. The specific circumstances and instructions regarding the requirement to file Form 8453 may vary, so it is always recommended to consult the instructions provided by the IRS or seek professional tax advice.

How to fill out form 8453 llc?

To fill out Form 8453-LLC, follow these steps:

1. Download or obtain a copy of Form 8453-LLC from the IRS website or an authorized source.

2. Begin filling out the form by entering the name and address of the LLC (limited liability company) in the designated boxes.

3. Provide the employer identification number (EIN) for the LLC in the appropriate field.

4. Enter the date when the form is being signed.

5. Include the signature of a responsible party for the LLC. This can be the LLC manager, managing member, or any other authorized individual.

6. If applicable, indicate the corporate officer’s title or position within the LLC, along with their telephone number.

7. Review the completed form to ensure accuracy and completeness.

8. Attach any supporting documents or schedules that are required for the specific purpose of filing Form 8453-LLC.

9. Retain a copy of the completed form and any attached documents for your records.

10. Submit the form and any accompanying documents to the appropriate IRS address as instructed in the form’s instructions or other filing guidance provided by the IRS.

Note: It is essential to carefully read and understand the instructions that accompany the form, as requirements may vary depending on the purpose and specific circumstances of your LLC. If you are unsure about any details or have complex filing requirements, it is recommended to consult with a tax professional or seek assistance from the IRS.

What is the purpose of form 8453 llc?

Form 8453-LLC is used by Limited Liability Companies (LLCs) to authorize their tax return preparer to electronically file the LLC's tax return with the Internal Revenue Service (IRS). The form serves as a declaration by the LLC's authorized representative that all the information on the tax return is true, complete, and accurate to the best of their knowledge. It is essentially a signature form that gives the LLC's consent for the tax return to be filed electronically.

What information must be reported on form 8453 llc?

Form 8453-LLC, U.S. Partnership Declaration for an IRS e-file Return, is used by partnerships to authorize an electronic return file and provide supporting paper documentation to the IRS. The following information is typically reported on Form 8453-LLC:

1. Partnership Information: This includes the name of the partnership, Employer Identification Number (EIN), address, and contact information.

2. Filing Method: The form will specify whether the partnership is filing as an electronic return originator (ERO) or as a third-party software transmitter.

3. Authorized Signers: The names and titles of the individuals authorized to sign the electronic return on behalf of the partnership should be provided.

4. Declaration of Electronic Filing: The partnership must declare that the return is being electronically filed and that the information provided is true, correct, and complete.

5. Documentation: The partnership must attach paper documentation, such as Forms W-2, W-3, 1098, 1099, Schedule K-1s (Form 1065), and any other required supporting schedules or forms.

6. Authorization: The individual(s) signing the form must authorize the electronic return originator (ERO) or transmitter to transmit the partnership's return to the IRS.

7. Signature: The authorized signer(s) must sign the form using a handwritten or digital signature.

It is important to consult the latest instructions and guidelines provided by the IRS for Form 8453-LLC to ensure accurate and up-to-date reporting.

What is the penalty for the late filing of form 8453 llc?

The IRS may impose penalties for the late filing of Form 8453-LLC, which is used to electronically sign and file partnership tax returns (Form 1065). The penalties for late filing can include:

1. Late filing penalty: If Form 8453-LLC is not filed by the due date of the partnership tax return, the IRS may impose a penalty of $205 for each month or part of a month that the form is late, multiplied by the total number of partners in the partnership (up to a maximum of 12 months).

2. Failure to file penalty: If the partnership fails to file Form 8453-LLC within 60 days after the due date (including extensions), the IRS may impose a penalty based on the total tax liability on the partnership return. The penalty is generally calculated as $210 for each partner per month (or part of a month) that the form is late, up to a maximum of 12 months.

It's important to note that penalties can vary based on the specific circumstances and the discretion of the IRS. It is advisable to consult with a tax professional or refer to the IRS guidelines for more accurate and up-to-date information on the penalties for late filing of Form 8453-LLC.

When is the deadline to file form 8453 llc in 2023?

The deadline to file Form 8453-LLC in 2023 would generally be the same as the deadline to file your LLC's tax return for the tax year 2022. For most single-member LLCs, the deadline would be April 17, 2023. However, if your LLC is classified as a partnership or has multiple members, the due date would be March 15, 2023. It is important to note that these dates are subject to change, so it is always recommended to check with the IRS or a tax professional for the most up-to-date information.

How can I manage my form 8453 llc directly from Gmail?

8453 llc form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find 8453 llc printable form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the form 8453 llc in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit 8453 llc form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 8453 llc printable form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your form 8453 llc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8453 Llc Printable Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.